Beginner’s Guide to Trading Futures on Binance: secret Methods and Risks Unveiled in 2023

Are you new to trading futures on Binance and feeling unsure about how to get started? This comprehensive guide is designed for beginners, covering methods and risks associated with trading futures

Disclaimer: The content provided here is for informational purposes only and should not be considered financial advice.

Are you new to trading futures on Binance and feeling unsure about how to get started? This comprehensive guide is designed for beginners, covering methods and risks associated with trading futures.

https://vdbaa.com/fullpage.php?section=General&pub=971445&ga=g

Before we delve into the step-by-step process of trading on Binance, it's essential to understand the basics of futures trading. Futures are financial derivatives used for speculating on the future price movements of assets, such as stocks, commodities, or cryptocurrencies. While it offers the potential for significant profits, it also involves substantial risk, as it requires trading on margin – a practice where both gains and losses are magnified.

https://vdbaa.com/fullpage.php?section=General&pub=971445&ga=g

In this guide, we will walk you through the process of trading futures on Binance, from setting up your account to executing trades. This guide aims to be your go-to resource for futures trading on the Binance platform.

**Understanding Futures Trading:**

Futures are contracts that allow traders to speculate on the future price of an asset. When trading futures, the price and date for buying or selling an asset are predetermined. If the asset’s price rises upon contract expiration, traders make a profit; if it falls, they incur a loss. Traders can also take a short position, profiting from price declines.

**Example Scenario:**

Imagine running a fuel station anticipating a rise in oil prices. To hedge against potential increases, a futures contract is entered into with a supplier, fixing the purchase price for delivery in three months. Regardless of market fluctuations, the agreed-upon price is honored at contract expiration.

**Benefits and Risks of Futures Trading:**

Trading futures allows speculation on asset prices, offering potential profits, especially in volatile markets like cryptocurrencies. However, leveraging is involved, meaning higher returns and higher potential losses. As such, futures trading is recommended for experienced individuals with a deep understanding of the market.

**Step 1: Setting Up and Navigating the Trading Screen:**

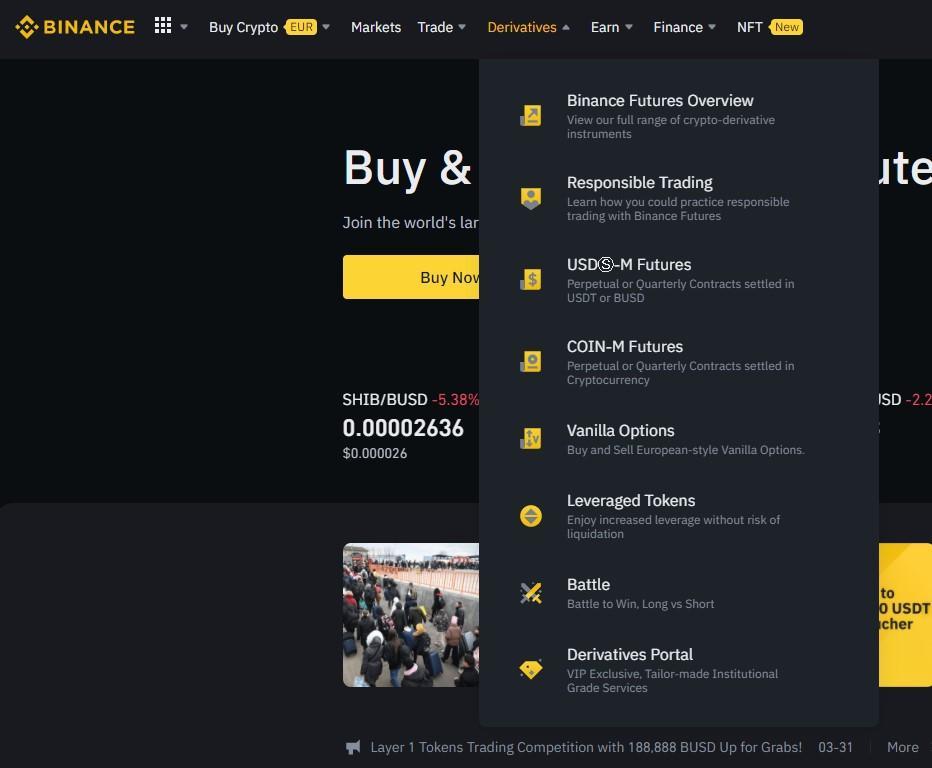

To begin on Binance, access the Derivatives tab, then select USD-M Futures. New users must take a quiz to understand crucial aspects of futures trading. The trading screen displays available futures contracts and allows users to choose collateral, either stablecoins or cryptocurrencies like Bitcoin.

**Understanding Leverage:**

Leverage amplifies trading positions. Binance offers leverage up to 125x, but it's advisable to start with lower leverage or even trade without leverage initially.

**Cross and Isolated Margin Modes:**

Choose between cross and isolated margin modes. Cross margin uses deposited collateral for all futures contracts, while isolated margin allocates funds to specific positions.

**Step 2: Trading Futures on Binance:**

Transfer funds from your spot wallet to your futures wallet. Navigate to the futures trading screen, select a contract, and enter the desired trade size. Execute buy/long or sell/short orders based on market conditions.

**Additional Trading Tools:**

– **Trailing Stop Order:** Lock in profits as prices rise, automatically adjusting when the market moves.

– **Take Profit/Stop Loss:** Set limits to secure profits and prevent excessive losses.

– **Grid Trading:** Automate trading by specifying price ranges for buy/sell orders.

**Risk Management:**

– Utilize Stop Limit orders to control losses and prevent liquidation.

– Recognize that futures trading involves derivative contracts, not the actual purchase of assets.

**Common Questions:**

– **Do I need leverage?** Leverage is optional; you can trade without it or choose a lower leverage level.

– **What is Funding/Countdown?** Long positions incur funding every eight hours, payable to short sellers.

– **How can I avoid liquidation?** Use Stop Limit orders to manage losses and prevent liquidation.

**Risk and Reward in Futures Trading:**

Understanding the complexities of derivatives and having a grasp of traditional markets can significantly enhance your success in crypto futures trading. However, it’s crucial to acknowledge the inherently volatile nature of the cryptocurrency market. While there’s substantial potential for profit, the risk of significant losses is equally present.

Moreover, the use of leverage can intensify both gains and losses. Binance's generous offering of up to 125x leverage should be approached with caution, especially for those just entering the world of futures trading. It's advisable to initiate trading without leverage or with a modest leverage level until you gain sufficient experience and confidence.

**Leveraging the Grid Trading Strategy:**

For those seeking a less hands-on approach to futures trading, Binance provides the Grid Trading strategy. This feature automates the buying and selling of futures contracts within a specified price range. By setting parameters such as the price range and the number of buy/sell orders (grid), traders can capitalize on market fluctuations without actively monitoring the market.

**Calculating Profits:**

Binance offers a native calculator to estimate profits on futures contracts. By inputting specific parameters, such as entry and exit prices, traders can gauge potential returns. Familiarizing yourself with this tool can contribute to informed decision-making.

**Stop Limit Orders for Risk Management:**

To mitigate the risk of significant losses and potential liquidation, consider implementing Stop Limit orders. Similar to the spot market, these orders automatically close positions if the asset's price falls below a specified threshold. This risk management tool is crucial for protecting your capital and preventing substantial losses.

**Addressing Common Queries:**

- **Do I Actually Own the Coins?** No, when you

, you're dealing with derivative contracts based on the underlying asset, not the asset itself.

- **Best Approach for Beginners:** Utilize the automated Grid Trading strategy initially to familiarize yourself with the dynamics of futures trading. As you gain experience, you can explore more hands-on strategies.

– **Leverage Requirement:** While leverage can amplify profits, it’s not mandatory. Beginners are encouraged to start trading without leverage and gradually incorporate it as they become more adept.

– **Understanding Funding/Countdown:** Long positions involve paying interest to short sellers every eight hours. Factor in this funding cost when planning your trades.

– **Leverage in

- trading futures leverage

:** Leverage allows you to control a larger position with a smaller amount of capital. Binance offers leverage up to 125x, but exercising caution, especially for beginners, is crucial.

**Conclusion:**

Trading futures on Binance can be a lucrative venture for those equipped with the right knowledge and strategies. The platform offers a range of features and tools to facilitate both beginners and experienced traders. However, success in futures trading requires a meticulous understanding of the market, risk management practices, and continuous learning.

As you embark on your futures trading journey, start with small steps, grasp the fundamentals, and consider lower leverage levels. Leverage can be a double-edged sword, amplifying both gains and losses. Therefore, it’s essential to approach it with prudence.

In the dynamic world of cryptocurrency, where markets can experience rapid and unpredictable movements, staying informed and adapting your strategy is paramount. Continuously educate yourself, stay updated on market trends, and, most importantly, practice responsible and informed trading on your journey through the exciting realm of futures trading on Binance.